Enter your details to download the white paper

In today’s increasingly digital economy, enterprises face a complex and evolving landscape of financial risks, with payment fraud being one of the most significant challenges.

As organizations accelerate their digital transformation initiatives, the diversity of payment methods—ranging from traditional checks to Automated Clearing House (ACH) transfers, virtual cards, and wire transfers—introduces varying levels of risk into their financial systems.

Understanding and managing these risks is crucial for safeguarding financial assets, enhancing operational efficiency, and ensuring compliance with regulatory requirements. The Payment Risk Score (PRS) provides a powerful tool to quantify and manage the risks associated with these payment methods.

What’s inside?

According to the 2024 AFP Payments Fraud and Control Survey, a staggering 80% of organizations experienced attempted or actual payment fraud in the past year, highlighting the urgent need for robust payment security measures as an integral part of any Enterprise Risk Management (ERM) strategy.

This white paper outlines a comprehensive approach to payment method risk assessment and provides practical suggestions for how to integrate the Payment Risk Score (PRS) into Enterprise Risk Management.

- The Importance of Payment Security in Enterprise Risk Management

- The Evolving Threat Landscape

- The Prevalence of Common Payment Methods

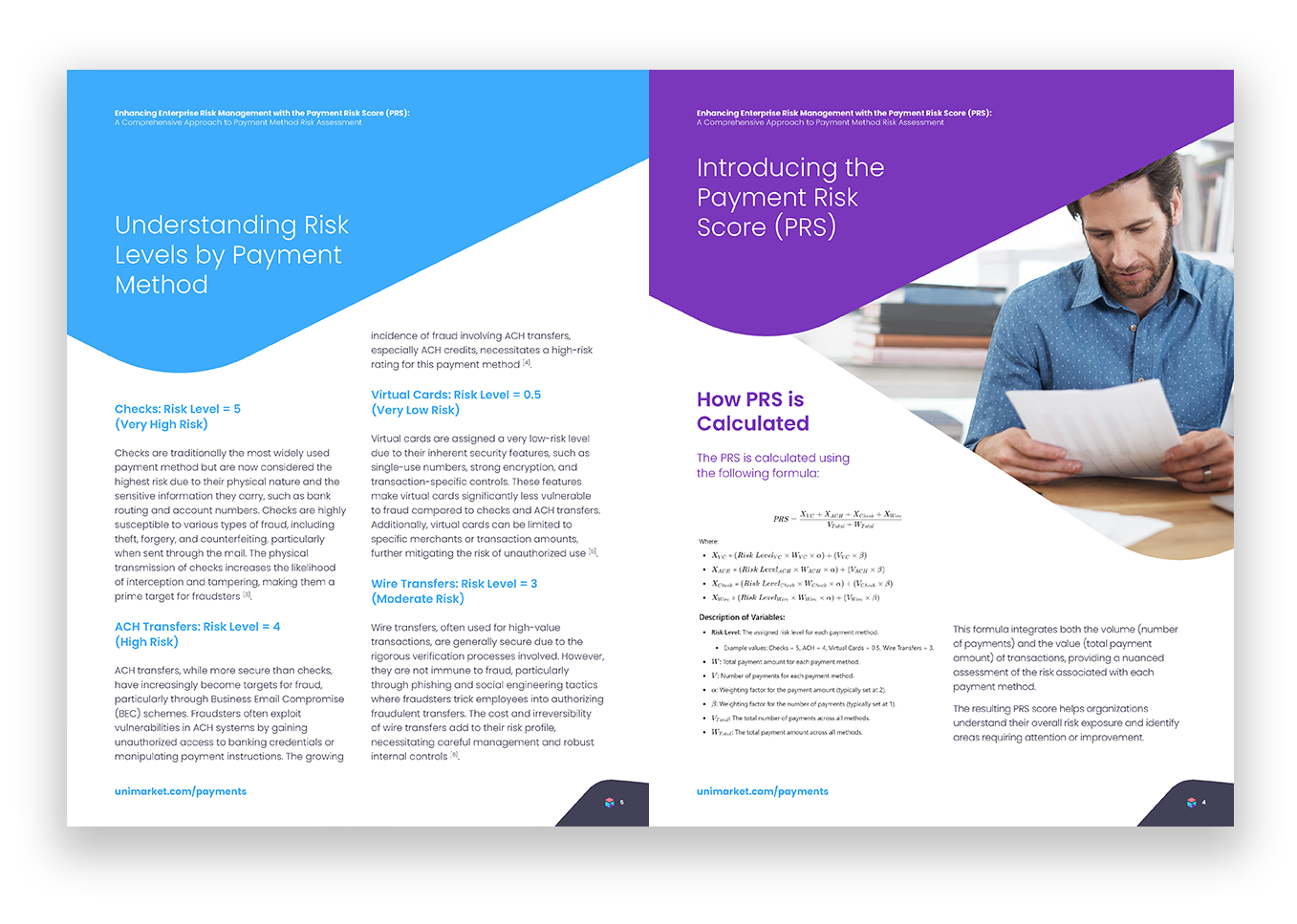

- Introducing the Payment Risk Score (PRS)

- How PRS is Calculated

- Understanding Risk Levels by Payment Method

- Rationale for Weighting on Each Payment Method

- Applying PRS in an Enterprise Context

- Case Study 1: High-Risk Scenario

- Case Study 2: Low-Risk Scenario

- Integrating PRS into Enterprise Risk Management

- Proactive Risk Management

- Supporting Compliance and Governance

- Continuous Improvement